Scalping Futures as a Trading Strategy

Introduction

*Disclaimer these posts are for educational and/or entertainment purposes only. If you want more warnings and disclaimers check every footer on every page, or click here, it sends you to the same disclaimer if you're too lazy to hit [end] on your keyboard. These posts are not advice, trades you do are of your own, if we hint to try something, it's to test on a demo or at your own risk, we never guarantee profitability.*

What is Scalping

In my definition from experience, scalping is very short-term, high-frequency trading done intraday, to capture small profits in the markets. Scalping involves quick judgment to execute quick entries, they capture the spread and commission first and then the profits (if they come) afterward.

What does chopping up vegetables have to do with scalping?

The headline photo makes you wonder, doesn't it? Let's use this analogy. Scalping is like chopping up profits in the markets. With your trusty knife (trading intuition and skill) you enter (slice) with precision. If you're a good chef (skilled scalper) you're going to produce a great dish (trading profits). If you're not good at it, however, you're going to produce a bad dish, or worse cut yourself (severe trading losses). I hope this analogy helps newcomers visualize scalping in trading. I try to make it as simple as possible.

Scalping as a viable Trading Strategy

Scalping is a viable strategy amongst many others, it depends on the trader's style and preference in the end.

The Pros

It limits risk (sort of)

Scalping when trading futures, can limit risk due to its short duration of trades. Some last a few minutes and some trades even last just a few seconds. The trader tends to use market orders to get in and out of trades as they'd rather participate actively and be in and out at their own discretion. The stops are there just for disaster events. They usually exit before stops get hit.

Scalping is very exciting

If you trade for thrills and excitement, then Scalping might be the trading style and strategy for you. It gets your adrenaline up coupled with the caffeine of some sort and you feel unstoppable. It forces you to be alert and aware at all times when it comes to the market and its every move.

Scalping has some of the most Asymmetric risk-reward ratios (if done properly)

I've seen some professional traders that are really good scalpers, take shorts near the highs of the day, all the way to the lows. They've kept stops so tight upon entry that their reward to risk was over 10:1. Meaning if they had a 10-point stop, they were able to trade it into a killer short that netted 100+ points or more. These are rare instances, they've happened during FOMC days before. The scalper focuses on the entry and chance to participate, if the market runs away in their favor, they will take whatever it gives.

The Cons

Scalping can be High Risk, low reward (HEY!)

You just said it's a limited-risk strategy. I did. Only if you trade it properly. Let me explain why it can be high risk, low reward. An inexperienced scalper can be trading improperly, and out of sync. Commissions are fixed expenses basically guaranteed inherent losses that have to be overcome. Low reward happens if a would-be scalper fails to overcome these costs, spread + commissions. There can be days you made $100 in profit, but you paid $99 in commissions. It can happen. Remember, the more you trade, the more you erode your future profits.

Scalping can be Psychologically Traumatic

If you're not in the right mindset to even trade, what makes you think you can even scalp properly? If you're feeling down, scalping is a means to insanity. It will worsen your mental state and this is bad for your account and your health. Always make sure you're psychologically sound before trading. Don't let personal issues affect your performance. If you feel psychologically compromised, don't trade that day. Simple. No one lost money by not trading, they just preserved it for another day.

It can be mentally exhausting

When scalping you're putting to work the strongest muscle in your body, for long periods of time, it is bombarded with data, numbers, colors, and flashing lights. Over time you will suffer from mental fatigue and brain drain. This fogs your judgment and focus. In turn, affecting your trading. As with the previous section about scalping being traumatic, make sure your mind is rested. Make sure it is fed, and maybe have a good breakfast and some coffee to keep you alert and awake. Don't let anything distract you.

Scalping: Some Examples

In the following section, I will present some Scalping examples. The identities have been altered to protect the innocent.

Scalping strategy examples.

- The M5 Levels trader: A trader friend of mine named Ken, specializes in short-term scalping in the 5-minute time frame. He's so good trading levels in the 5-minute chart, he bought a BMW M5 with his profits to reinforce his trading ability in the M5 time frame. ridiculous story in my opinion, yet a decent one.

- The candle scalper: This trader, Jenny, specializes in trading candle patterns, she considers herself the candle queen intraday. She trades certain patterns on the 10-15 minute charts and scalps those trades based on their direction.

- The HMA intraday scalper: Trade Joe (No relation to the store chain) trades 15-minute charts relying on a fast HMA, to portray price waves on the chart which he can follow. He states the visualization is clean and helps in his decision-making.

- The momentum scalper: Lastly Trader Sasha, trades momentum indicators to confirm her scalp trades. She uses the crowd's commitment to push prices and lets them take her into trades. She always trades with stop entries and never enters using market orders. However, she always exits at the market. It's an unorthodox and uncommon way of trading but works well for her.

This quick listing shows the variety of scalping methods within scalping itself. I will go into further detail next.

Ken: The 5-Minute Levels Scalper

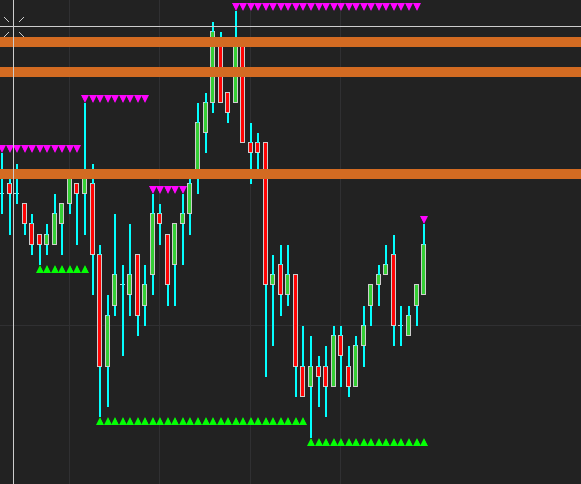

Ken is a notorious scalper. He trades only the 5-minute charts without too many indicators.

Looking at his charts, he keeps it very simple. 5-minute charts with drawn-out levels which he trades from. Ken states:

My trades are like swing trades but sped up, the swing traders trade for days and weeks. Mine last for minutes to only a few hours.

He keeps his strategy simple and purely discretionary. He said he doesn't have set rules and enters based on gut feeling and perception of the mob mentality of the market. With levels drawn, he knows theoretically where he wants to participate. He asks the question

If price is at that level do I want to short/long? Yes/no?

Based on the answer he executes and keeps risk tight. Stops are usually around the swing highs or lows. What about his exit? His trade exits are discretionary also, he looks for reversals at later levels, if he is short and he drew out a level to target, let's say the intraday low, he expects the price to react at that level and he exits out of the market.

Very simple.

If the strategy works for him, he should keep trading it. A strategy should be customized for your own goals. As for Ken, he is hitting those goals and trading for a living.

To commemorate his success in trading the M5 timeframe, he bought himself a BMW M5! Congrats Ken!

We all have to enjoy our successes at some point. As long as Ken's strategy works for him, I'm sure he will sustain his future successes.

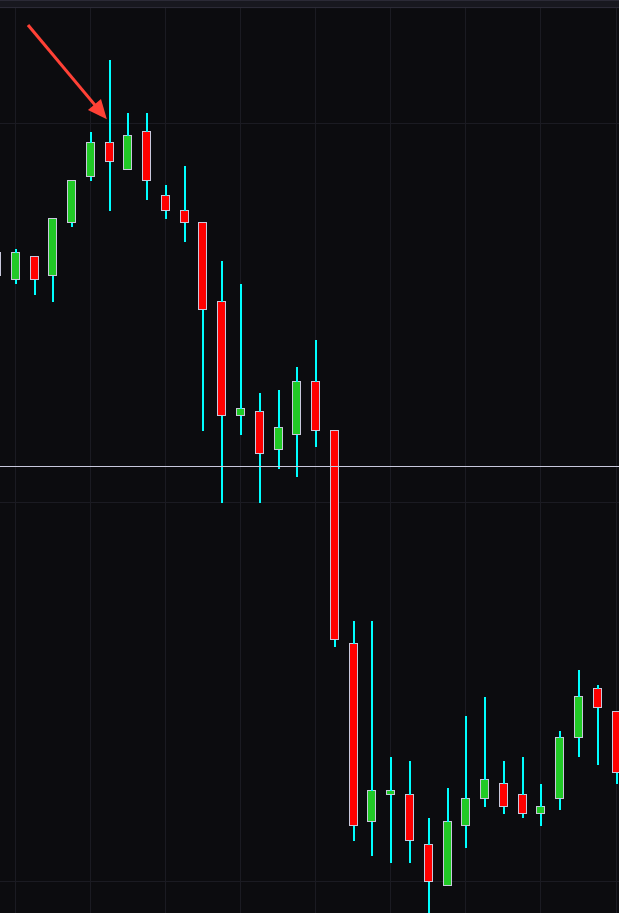

Jenny: The Intraday Candle Queen

Jenny is a scalper that trades strictly candlestick patterns. She says simplicity is key when scalping. You don't need complex rules and variables when scalping, the faster you can make a decision, the more improved your trading results will be.

Her criteria for trading are as follows.

I look for red candles with long wicks above to short, basically a shooting star. Red only for shorts. If it's a shooting star pattern and green I ignore it as a false signal.

The opposite is true for longs, I look for green candles only, that have long wicks below, basically a hammer pattern. I ignore the red hammers.

With that said she says it limits her risk by taking only trades that are visible through her criteria, if she's wrong, then the loss was acceptable. If she's right, the trade tends to be an entry for a trending day and her rewards outweigh the risk.

I found it impressive to have a simple system and apparently, it works well for Jenny.

As Bruce Lee says:

I fear not the man who has practiced 10,000 kicks once, but I fear the man who has practiced one kick 10,000 times.

In this case, Jenny must have traded these patterns extensively with great success, as she's able to support her family and work from home and be with her kids. Maybe she'll teach them to trade when they grow up!

Trader Joe: The HMA Scalper (No affiliation with the store!)

Trader Joe likes waves on a chart. Clean visualization apparently makes for easy decision-making.

If you look at only the HMA and check for a candle cross below or above, trading will be easier. It is for me!

When I analyze the chart, for me it looks noisy even in the 15-minute timeframe. Given the HMA is a lagging indicator (moving averages are lagging in nature). There can be false signals. False signals can lead to losses.

Though I don't agree with his strategy and it likely won't work for me, it apparently works for Trader Joe. He too is retired and trades for a living. So I'm no one to question his success.

It goes to show you there are many strategies for everyone and it's great to see their processes even if it's not what you prefer. Well done Joe!

Trader Sasha: The Momentum Scalper

Trader Sasha has an unorthodox way of trading. It's another method I probably won't try but let's take a look.

Sasha trades off a 10-period momentum oscillator. She has it set to a histogram. Her rules are as follows.

I bracket the momentum indicator with horizontal lines at the +10 and -10 levels. When the oscillator breaks either way, I have an OCO bracket order to buy or sell to take me into the market. When I get in, I watch the trade, if it advances I stay in, if in 15 minutes it doesn't advance in my favor, I exit and wait for another momentum break. I enter with stops and exit with market orders. The crowd's commitment to a direction helps my scalp trade. You have to trade it to see how it works.

I find the approach very interesting as it takes a really focused trader to trade such a scalping strategy. The market would test your resolve as the entries usually won't be the most optimal. Stops can be prone to slippage (though my preferred market orders when scalping fare no better). The exits at the market are understandable. However, the reward to risk must be variable.

Nonetheless, if the strategy works for Sasha she should keep trading the most effective strategy at her disposal.

Closing Remarks

In this entry, you learned about what scalping is. You also learned about the risks and rewards of scalping along with its pros and cons.

Also, I went over some scalping strategy examples used by 4 trader friends of mine. The strategies showed various dimensions of scalping that are new, uncommon, and at times unorthodox. These strategies show that there are multiple approaches to generating alpha in the markets

With that said I hope you enjoyed this entry on Scalping as a strategy. It is an exciting strategy with its own set of risks. It isn't for everyone, certainly not for the longer-term trader. If you like scalping you can test strategies or devise your own. Run it on a demo as always before deploying live capital.

If you find these journal entries helpful, please consider subscribing here. The team at A81k is grateful for your support.

Trade Well,

~Asymmetric_Vol

Entries of Interest