How to Get Started in Futures Trading

*Disclaimer these posts are for educational and/or entertainment purposes only. If you want more warnings and disclaimers check every footer on every page, or click here, it sends you to the same disclaimer if you're too lazy to hit [end] on your keyboard. These posts are not advice, trades you do are of your own, if we hint to try something, it's to test on a demo or at your own risk, we never guarantee profitability.*

Getting Started in Futures Trading a Primer

You as a new trader in this space might be overwhelmed and don't know where to start. Rest assured Asymmetric_Vol's entry on how to get started in futures trading will be a valuable asset in your journey. If you opened a stock brokerage account, you might be experienced already, and getting started might be easier than you think. Let's go.

What is a Futures Broker?

A futures broker is a brokerage that specializes in granting you access to trade futures with their firm. They set up accounts and offer trading platforms to execute trades in the futures markets. For this service, they charge a commission for every trade. Unlike equities, there are no futures brokers I know of that offer free commissions.

Zero-commission trading comes at a cost

In equities, almost all firms offer $0 trading commissions, the cost with this is some firms sell their orders to the largest electronic market makers to be able to offer $0 commissions. This is called payment for order flow. A lot of the new broker startups like Robinhood & WeBull use this kind of business model, they sell your orders to the likes of Citadel Securities and Virtu Financial.

What are the costs you ask?

For starters, in equities trading, given most participants trade in small sizes under 100 shares, your orders get pooled with other small orders until the broker reaches a market minimum lot size trade, which is 100 shares usually for equities. You're usually not going to get the price you want, there will be slippage, etc. This is the price you pay for "free".

Let's get back to Futures Trading.

It is important to choose the right futures broker

Choosing the right broker that's in line with your objectives will be helpful in your futures trading journey. They will have the trading platforms, trading support, service, and tradeable markets that you want.

Factors to consider when selecting a Futures Broker

Here is a personal checklist in terms of broker selection.

- Trading Platforms: do they have a desktop platform? web? mobile? demo trading? Some brokers have an array of platforms to test, some are free some cost money, test the ones that you feel are in line with your objectives. Some tools are worth having and worth the cost.

- Fees: Some brokers are discount brokers, some are more full service, some cater to day traders, and others are good for managed accounts.

- Margins: Some have intraday margins that are very low $400-500 for emini SP500 and $40-50 for micro contracts, these target day traders. Some brokers have higher margin requirements to limit their risk exposure from client trading.

- Segregated accounts: You should select a broker that keeps your funds in a different bank account, in case of default and solvency your funds are protected at the external custodial account. Your profit and losses (PNL) are credited and debited from your external account daily.

- Treasury services: ACH deposit/withdrawal. Wire Transfers, Check processing, etc.

- Customer Support: You need a broker to answer your emails and pick up your calls in 1 ring and a dedicated emergency trade desk in case you need to get out of your positions when you're unable to via platform or app.

Selecting your Futures Broker

If you're going to day trade.

You will have a lot of trades so what you might do is to find a broker with the cheapest commissions possible. Micros should be around 0.75 cents or less per trade for micros and for Eminis it should be $3 or less per trade, the more you trade the lower your commission rate that you should hunt for. A round turn(RT) is double the value of the cost per trade. Round Turn means opening & closing trade, in and out, so RT for micros should be $1.50 or less and Eminis should be $6 or less RT for day traders.

For swing traders, trend followers & position traders.

The commission rates might not matter as much since your trades will be of a longer duration. Thus the commission effect is smaller against your PnL. These traders should have a broker that has good phone support and maybe a mobile app so you can trade and check positions once a day or so.

Margins for your selected brokers.

Day traders should take advantage of intraday margins of $500 or less for Eminis. Remember risk management, just because the margins are low doesn't mean you should overleverage yourself. This is a surefire way to get margin called, account locked, restricted, and closed. So day traders be mindful and responsible with your trading.

Swing, Trend & position traders should only worry about the initial margin required to hold a position overnight. As per CME Group:

Initial Margin requirements range from 3-12% of the contract's underlying value. This is subject to the discretion of the broker. ***Initial margins can spike to 25%-50% depending on the broker if there are sensitive economic releases, interest rates, etc.

For the longer-term traders should be able to post double the initial margins, for example, if a micro contract requires $1350, It's advisable to have $2700-$3000 in your account per contract to avoid margin calls. This will have the broker look at you as a responsible trader that knows how to monitor risk.

Trading Platforms offered by the Broker.

The platforms should suit your needs. Day Traders should have a dedicated desktop platform with advanced charting and an emergency trade desk you can call during all open market hours (23hrs a day). Also please trade with a wired connection. There are too many risks in trading on wifi, data breaches, signals and lost packets through walls of your residence before hitting the router, thus causing a failure in the execution of trades. Also don't day trade on a mobile app, refer to the same reasons above regarding wireless connections.

If you're a serious trader, don't play games, treat futures trading as serious business because those who do are the ones that take money from those who play around. Use the right tools dedicated to this line of work. As you progress in your trading journey you will level up and see the value of platforms that cost money to use.

Futures trading is instantaneous feedback when it comes to results, you're either winning or losing, red or green, up or down. Aside from a physical hit, there is no harder reality check. ~Asymmetric_Vol

For longer-term traders, swing, trend & position, you might be on the go and trade part-time, so a broker that offers a mobile app would be beneficial so you can check your charts and positions. Or you can utilize the web app if they have one, so you can do some trading or position management on your laptop.

Lastly Customer Support.

Customer support is necessary for a broker's longevity in the business. As a trader, you don't want to feel like you're trading alone. You need a broker that will pick up the phone, answer account questions, troubleshoot platform issues, and a trading desk that will execute trades for you, in terms of closing positions. As a risk management function, some futures brokers have dedicated emergency trade desks that will flatten your account (close all positions) when you call in because you can't access the platform for some unfortunate reason.

Extra info: My preferred Futures Broker?

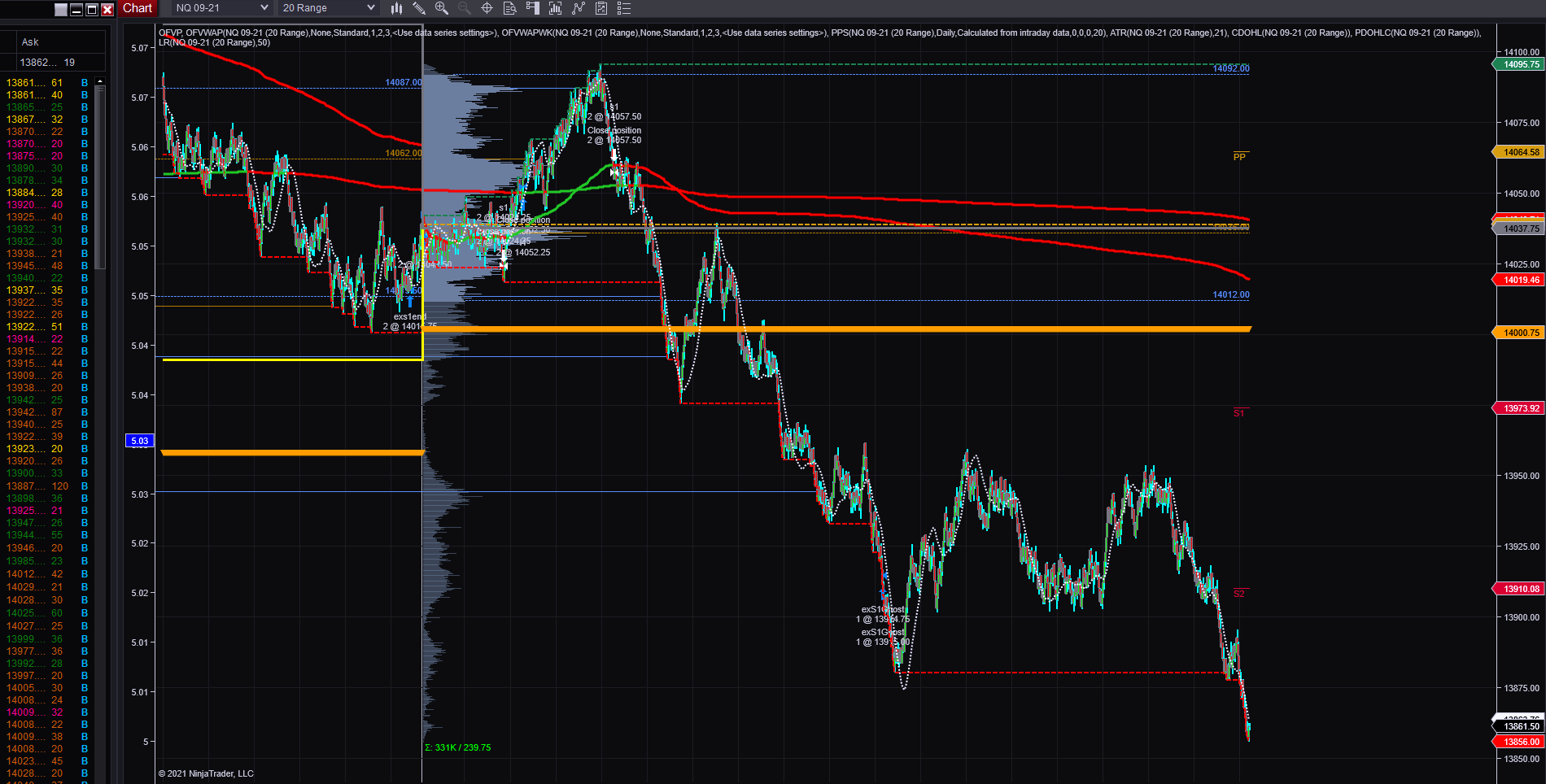

Some of you might be pondering my Futures Broker of choice. This would be NinjaTrader Brokerage. Why? Because as I stated above, select a broker that fits your needs, This broker does that for me. I've been with them since the late 2000s when they were a small company and didn't even have a brokerage. They had NinjaTrader 7 before they have the current superior NinjaTrader 8 (NT8) platform.

When I need to day trade I can do it, when I want to trade longer duration, I can do that as well. I learned algorithmic trading and development through NT8 so their platform and ecosystem are beneficial for my trading operations. Their emergency trade desk executes free of charge, there are no broker-assisted fees like in equities trading. Lastly, the customer support is great, they resolve any issues in 1 contact usually.

I will do an in-depth review of NinjaTrader Brokerage in the future along with Trading Platforms.

Some honorable mentions are AMP Futures and RJO'Brien Futures. These 2 Brokers offer competitive rates and a vast array of trading platforms to choose from. Other trading platforms I would like to mention with honor are Trading Technologies (TT) a cloud trading pioneer and CQG, which has been developing execution platforms for decades.

Remember trade with a futures dedicated broker, not one that trades multiple markets along with futures.

Further insight on Broker offered Platforms

Platform Ease of Use is a helpful component.

Along with the previous offerings I covered earlier, ease of use is critical. The broker should have starter guides on using their trading platform.

They should also offer a demo account for 2 weeks or longer. Try to get an indefinite demo when starting so you can take your time and get familiar with the platform and its controls.

When trading on the demo, you will notice the quirks of the platform, what feels good to use and what doesn't.

For day traders are there hot keys? Do they offer multiple order types?

For longer-term traders when you trade on the phone, does your trade get reflected on the desktop platform just in case you want to manage the position?

For all traders, how easy is the order entry? Is it a single-click execution? Or do you have to go through different windows and buttons to trade? These nuanced details can be deal breakers for platforms and brokers. If you think about it, how can you work with a broker if the tools don't work as you'd like?

Given futures trading is a more advanced form of trading versus equities, the platforms might have a slightly steeper learning curve. This goes back again to the broker having good service in the sense they'll do their best to make it easy to learn and use the trading platform in hopes that you open an account with them.

Opening a Futures Trading Account

Believe it or not, this is the easiest part.

After test-driving the brokerage and its trading platform, you might conclude that you want to trade with them. Wonderful, next I will list what you need in terms of account opening, this is very similar across all brokers in the industry.

- You need your Email, ID, Social, and a Checking Account

- Go to the broker page and click Open Account, or you can have one of their brokers assist you in opening the account.

- You will fill in typical information, address, questions about trading experience, your objectives, and if you're a licensed professional (which I hope you're not as it affects your fees)

- After all, forms are filled out online, make sure to save a copy for your records.

- Hit submit, and the broker will process your application, usually, this is done within 1-3 business days.

- When cleared, deposit an amount of risk capital you're comfortable losing. You do this via ACH if it's offered by your broker, or via Wire Transfer. The broker will give you the banking details in which to send the cleared funds.

- If you're new, please start with micro contracts, they're 1/10th the size of the Eminis and they're a 10th of the stress.

- You can learn to grow a small account this way and eventually trade larger.

- Depositing $2000-$5000 to start is usually a good amount. Sure some brokers have no minimums and you can trade by just putting up the intraday margin, but you'll get margin called the moment you fall below that, so you're gonna get flagged as a risk to the broker.

- Be responsible and deposit an adequate amount of risk capital. You don't want to be depositing every day because you traded with the bare minimum and your inexperience handed you your first set of losses.

When All is Said and Done

Your Futures account is Almost Open.

I hope this journal entry in selecting your Futures Broker is a helpful one.

I tried to go into detail based on my experience, the do's and don'ts when selecting a broker. What to look for, is the fee structure, service, and trading platforms. Refer to the checklist I listed earlier.

Look at the broker as being part of your team, they need your long-term service to exist, they don't want traders blowing up their accounts because that means no commissions for them to earn.

Look at the trading platforms as tools for trading. The best craftsmen, players, athletes, etc, don't compromise on their tools and equipment. Neither should you. Armed with the knowledge I've bestowed upon you, you're able to research brokers and platforms to suit your trading needs. Remember when something is deemed "free" it cost someone something to make it "free".

Lastly, if you found this entry helpful consider subscribing, You will get posts that are subscribers only along with opinions and insight not available to non-members. It enables me to provide more in-depth writing such as these you won't find anywhere else. There's no substitute for experience and I am grateful for your support.

All the best,

Asymmetric_Vol

Entries of Interest

What is Futures Trading

5 Favorite Strategies

Day Trading