Futures Trading, What is it?

*Disclaimer these posts are for educational and/or entertainment purposes only. If you want more warnings and disclaimers check every footer on every page, or click here, it sends you to the same disclaimer if you're too lazy to hit [end] on your keyboard. These posts are not advice, trades you do are of your own, if we hint to try something, it's to test on a demo or at your own risk, we never guarantee profitability.*

An Introduction to futures trading

Why do I focus on futures trading? I Asymmetric_Vol, believe it's a fascinating segment of trading. It's different from other asset classes and presents an array of advantages over others. Not to mention, it offers opportunities that aren't found in equities (stock) markets or foreign exchange markets.

My Definition of Futures Trading

It is the speculation of futures contracts for profits while minimizing losses, taking calculated risks with high potential rewards. The speculation and risk taken is that of a trader/speculator and not a hedger.

As per CME Group, their definition of futures trading is as follows:

Forward and futures contracts are financial instruments that allow market participants to offset or assume the risk of a price change of an asset over time.

Source: CMEgroup.com

As you can see CME Group's definition is close to my definition with a broader focus on all participants including hedgers.

My Futures Focus

Let's delve into what futures I focus on. Primarily my favorite markets to participate in are the equity index, rates, energy, and metals.

Equity Index Futures

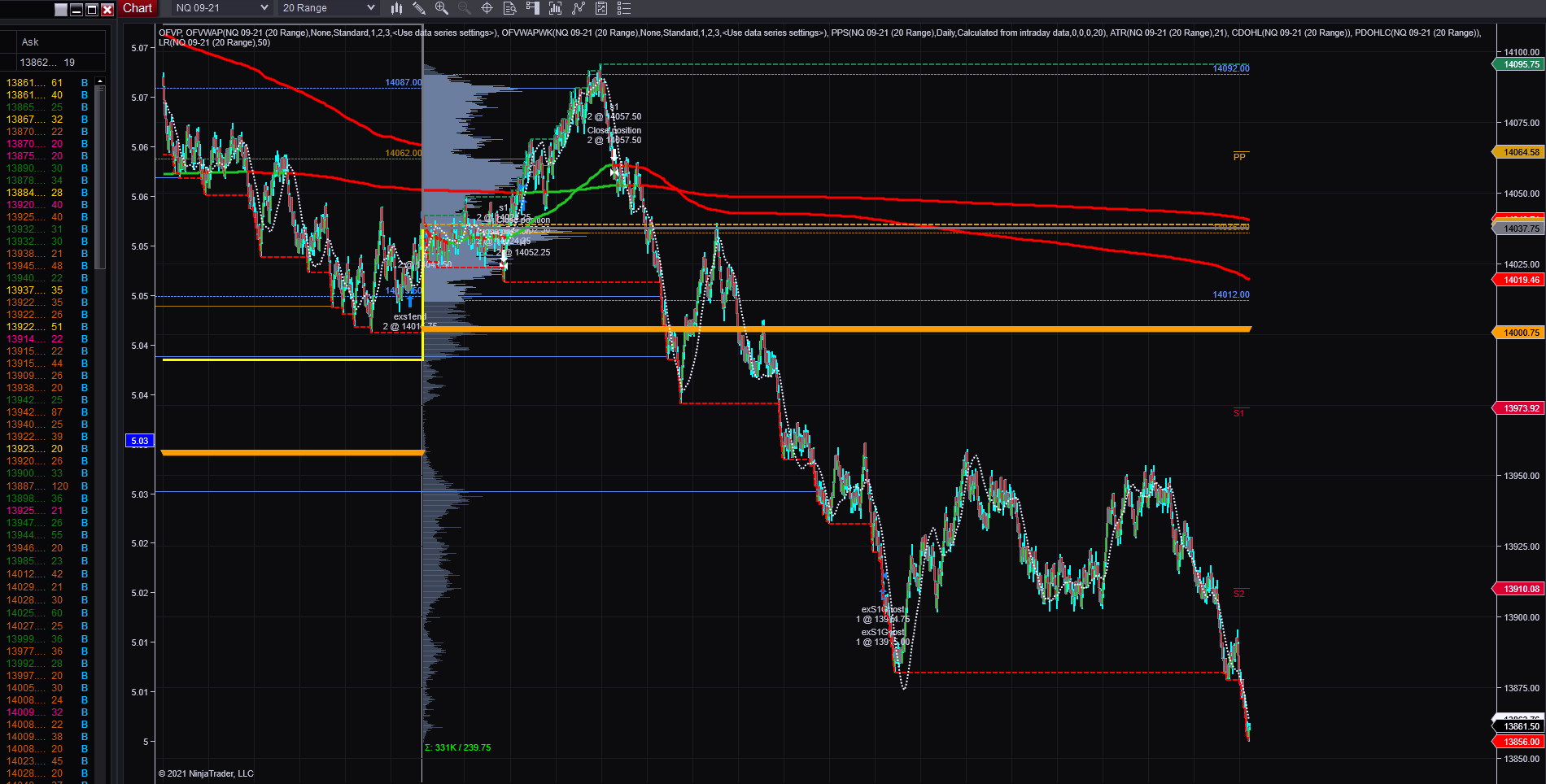

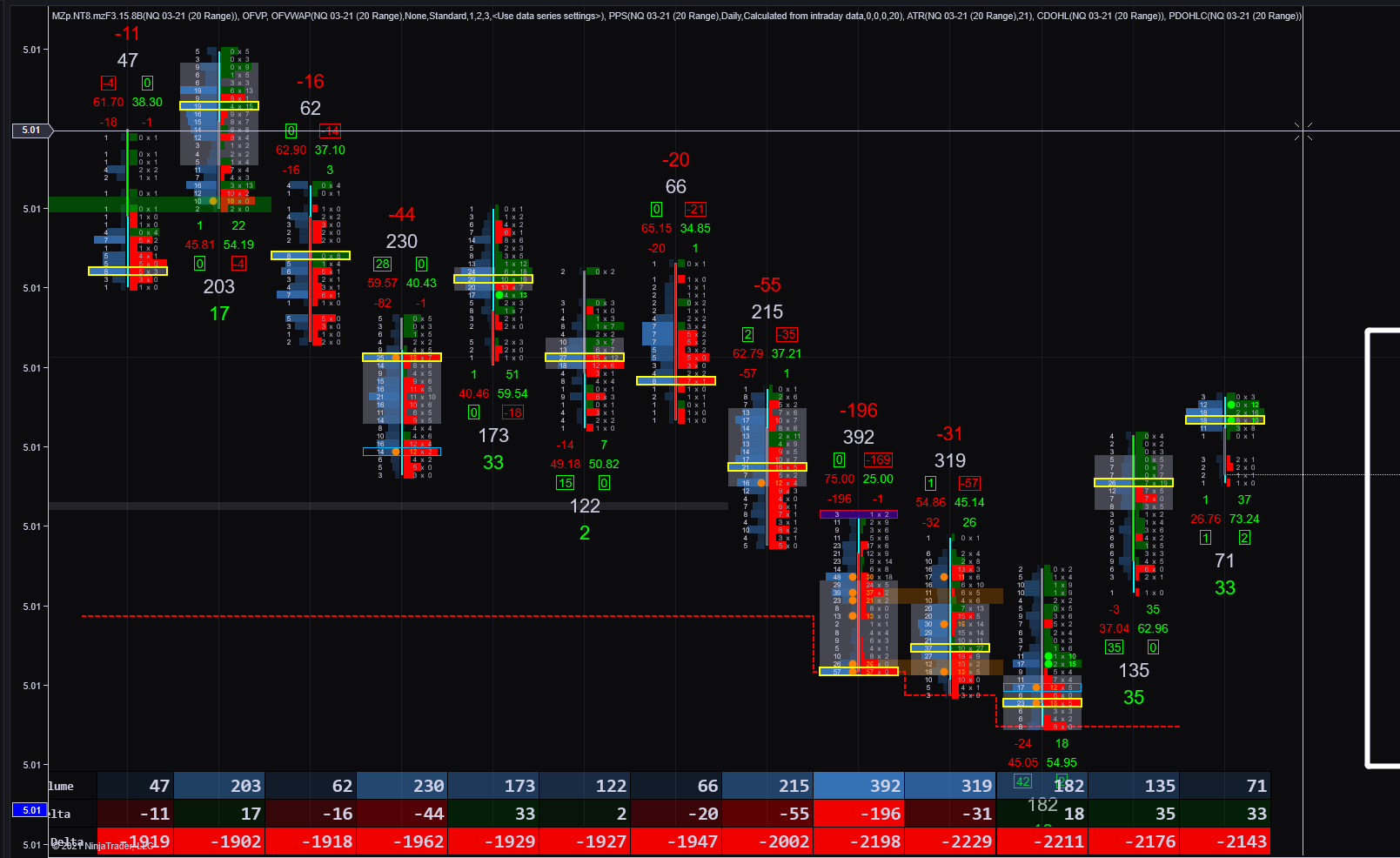

For equity index futures, I focus on emini Nasdaq100 futures (denoted as /NQ from now on) as the futures contract with the highest potential for returns, and the emini sp500 (/ES) for volatility stabilization in this equity index segment.

Questions about exposure to multiple indices?

One might question, you're in market indexes, you're basically doubling your risk as they have some correlation! Yes and no, yes double the risk if I believe the risk is worth taking and the market is risk-on (rallying), meaning the chance of profit outweighs the defined risk (the same is true when the market is risk-off, selling off, or crashing). No in terms of using one index against another, one can be used to offset another, not as a perfect hedge but to adjust and reposition or absorb some capital bleed (unrealized losses) from losses. I love the power of optionality. The ability to have choices and options is priceless.

Energy Futures

For energy markets, I focus on Crude Oil (/CL) black gold. This commodity is paramount in terms of trading energy due to its liquidity and its counter proxy against the dollar. I have the notion to trade against the dollar, meaning I don't want to be in dollars when deploying capital, I get paid out in dollars when I flatten positions. When trading and taking on risk, I don't want to be in anything that replicates dollar performance. /CL futures present another venue of asymmetric returns due to their volatile nature towards global shocks and geopolitical surprises.

Precious Metals

For metals, I focus on Gold Futures (/GC). The metal of the gods. It can be had by humans for the godly price of nearly $2000/oz as of writing. Decades ago, gold was $30-40/oz now it has advanced to almost $2000. Going back to my counter-dollar stance, Gold is the undeniable portrayal of the dollar losing purchasing power, with excessive quantitative easing, money printing, and wealth destruction due to excessive deficit spending. Gold existed before the dollar and other currencies and will exist long after. It can't be printed, it has to be mined, and it's robust and very tangible. Gold is another commodity that is sensitive to shocks and geopolitical factors.

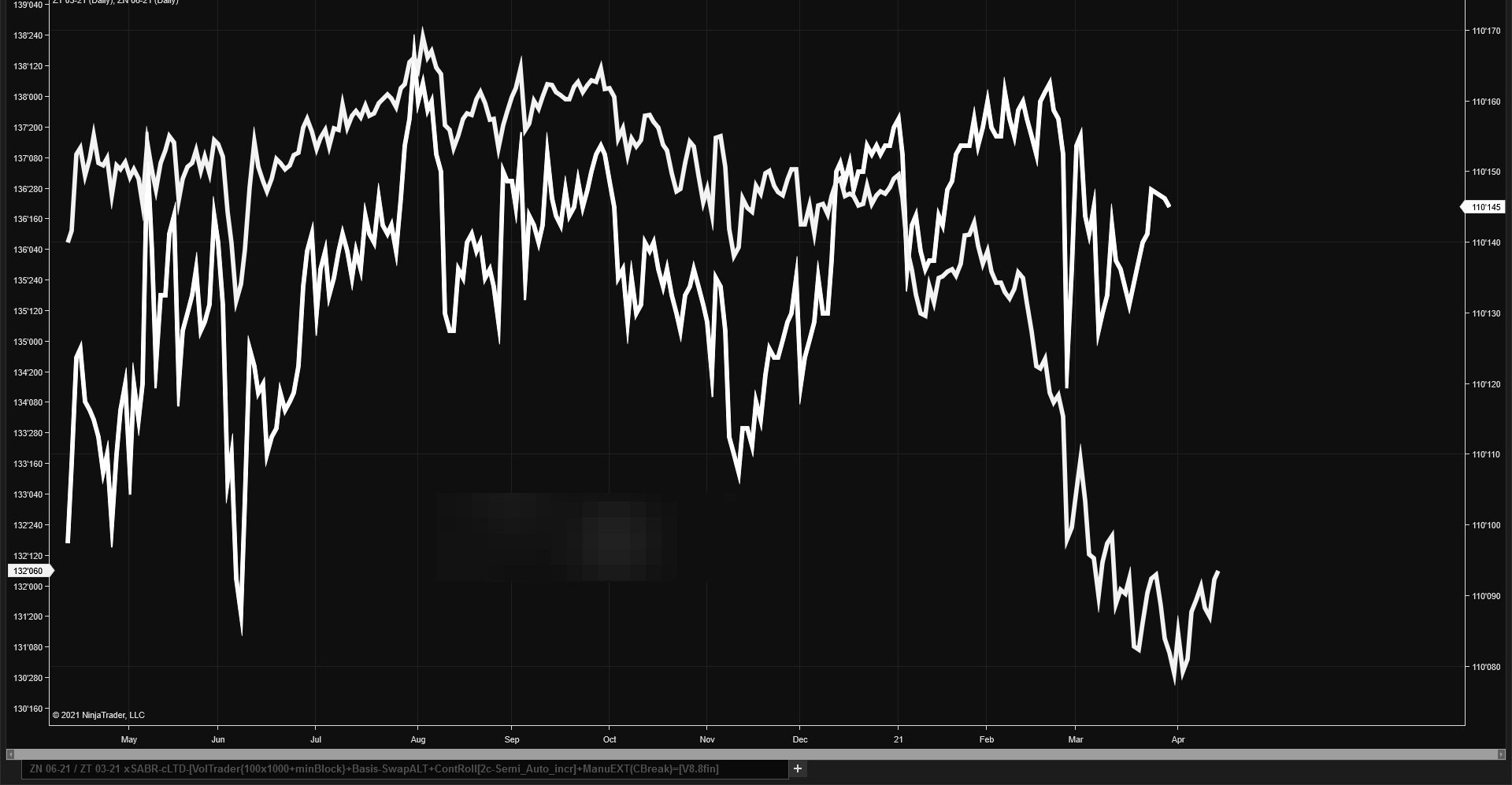

Interest Rates

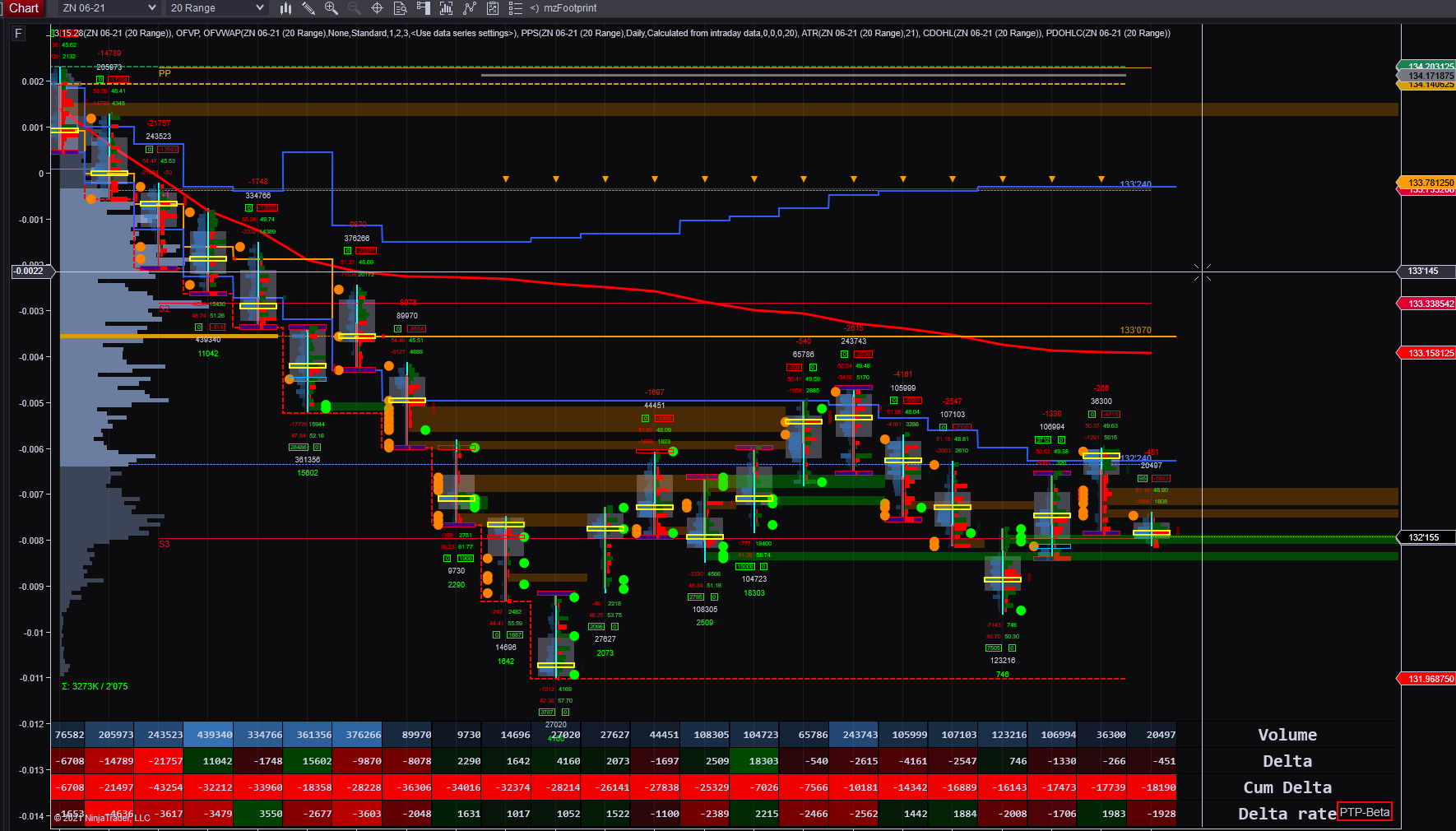

Lastly in the rates space, I focus on the 10-year micro treasury yield futures (/10Y). This is a new micro product introduced in 2021 that tracks the 10-year yield, it's smaller and makes it easier to fine-tune risk exposure. The CME Group offers micro treasury yield futures all across the yield curve, from 2Y, 5Y, 10Y, and 30Y. The reason for my focus on the 10Y is that it isn't too short or long in duration and it is the most liquid of all 4 micro yield futures. Before we had to trade bond futures to speculate on rates.

CME Inventiveness

Thanks to CME Group's ingenuity they now have a contract that focuses on the interest rate yield itself. This is my proxy to being in bonds but not wanting to be in cash or wanting to be in a larger bond futures contract like the Ultra U.S. Treasury Bond Futures (/UB) or 30-Year U.S. Treasury Bond Futures (/ZB). It's a lower volatility instrument as it's smaller in size than the bond futures. Furthermore, it gives me good optics in terms of rates projection, versus trying to use Bond futures as a proxy for rates trading while referencing the yields. We can now trade something derived from rates itself.

I hope my above detailed definition of futures trading and its meaning to me and my focus in terms of markets help you in understanding my thought process.

Futures Trading a good Future Skill (pun intended)

I strongly believe it is. It gives you the ability to make money in ways beyond your normal career. Once you learn this skill, it can't be taken from you. With that being said, I'm not saying futures trading is easy, but far from it. I like referring to cliches to put things in perspective. But:

There's a million ways to make a million dollars.

Just because you can play catch doesn't make you a gold glove contender.

Mastery of Futures Trading takes a long time

With that out of the way, the skill can be learned but it takes decades to master, and even if you feel like you mastered it, you will yearn for more knowledge because the markets will adapt and change. From experience, what worked for me in terms of trading in 2009 doesn't work today. Market volatility relative to then is higher due to higher index valuations and more liquidity in terms of cash floating around to absorb volatility.

Strong Concepts Applicable in the Future

Futures trading will teach you many concepts that are applicable to other markets or life in general. With automation soon erasing repetitive careers, one must adapt their future skills and acquire new ones. AI and automation are currently sweeping the world. Futures Trading is poised to take advantage of this phenomenon. It synergizes with this advancement because automated trading existed before the AI revolution of 2023. I believe it will strengthen the future space over time. New markets and contracts will be available and in turn new opportunities to make α will exist.

So what is Futures Trading?

Let's define this in a general sense:

Futures are derivative financial contracts that obligate parties to buy or sell an asset at a predetermined future date and price. The buyer must purchase or the seller must sell the underlying asset at the set price, regardless of the current market price at the expiration date.

As per Investopedia, Schwab, Wikipedia here.

Thus trading in these contracts involves "Futures Trading".

A Trader Example

An example of Futures Trading from the perspective of a trader/speculator is, the trader is bullish on oil, supplies are low and summer is near with heightened travel, thus potentially driving up the future price of oil. The trader goes to his broker and uses the trading platform to buy 1 contract of crude oil expiring in a month speculating that the price will rise prior to the summer season. He will sell off the position 1 week before expiration because they just want the capital gains, not the physical barrels.

However

If the trader is wrong, and OPEC+ decides to increase output by 50% more than the previous year to meet demand, then the trader will potentially suffer a capital loss on the trade.

The different types of Futures Contracts

Futures contracts come in various forms, some examples are the following:

- Financial Futures: These are futures contracts tied to Foreign Exchange (FX), bonds, and equities. These underlying assets can have near-infinite supply.

- Commodity Futures: These commodity futures have a finite supply and have to be mined or grown. They are physical in nature and likely have a strong necessity in terms of the functioning of daily life. You can't print these out of thin air. Think of Gold, Oil, Wheat, Orange Juice, Corn, etc.

- Interest Rate Futures: These futures contracts tend to deal with interest rates generated by central banks of the world. Think of Treasury Bonds, Eurodollars, or the new SOFR which replaced LIBOR.

Risks Involved in Futures Trading

Trading in futures can be lucrative or devastating beyond your wildest dreams. Be warned. The lure of riches has transferred whatever capital the inexperienced speculator had, to the accounts of those who trade for a living or professionally. Making a mistake in futures trading can be a fatal mistake.

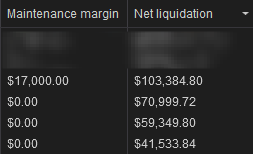

You can lose MORE than the balance of your account

Unlike stocks, which only go to 0. Futures can go negative and you will owe the difference to your broker as per the broker agreement you signed prior to opening your trading account. Margin calls are a reality if you're under-capitalized, meaning you trade with the bare minimum to meet margin requirements. You will just churn your account and the broker wins by farming your commissions and waiting for your account to blow up.

"Zero-Sum Game"

I strongly believe the analogy of Futures Trading being a "Zero-Sum" game is true. I see futures trading as just a risk transfer between two parties known as counterparties. For a futures contract to exist, it has to exist between 2 parties, 1 sells to open and the other buys to open this equals a contract, enforceable per exchange rules. These contracts are collateralized against the assets between both accounts of the counterparties. The broker matches the buyers and sellers and wishes them luck. Ultimately taking their commission for brokering the trade between parties, sometimes it could be another counterparty, or it could be your broker.

Further Risks to be aware of when trading Futures:

- Margin Risk: Your broker can increase margins to trade futures at will. They often do this as a risk management function on their end. It ensures that they kick out overleveraged accounts and lower their overall risk in their books.

- Liquidity Risk: The inability to execute at a specified price due to numerous factors not limited to fast market conditions during news releases, slow market hours, sleeping market makers, faulty algorithms, market limit up/down conditions, circuit breakers in effect, connection outages, server outages, lost data packets, data feed disconnections and hardware failures to name a few. The inability to execute a buy or sell order can result in losses/slippage and unfavorable positioning relative to strategy expectations.

- Market Risk: The ultimate risk is when you're dead wrong and the market moves against your initiated position. It's possible you're the last buyer and then everyone after you is a seller, you see this every day watching your charts, when a top forms, for the high to exist someone had to have bought and sold at those levels. There will be an ultimate winner and loser at those extremes.

Potential Benefits of Futures Trading

With the risks previously defined, we will now discuss the potential rewards of futures trading because, let's face it, if it wasn't worth the risk we wouldn't be trading it.

- Impressive profit potential: Let's take a commission cost of $4.18 round trip on 1 /ES contract. I had a sell stop pending on a Fed Rate decision, betting that the Fed Chair will say something hawkish and try to tame inflation with increased rates, basically higher rates = depressed stock market. The market rallied 20 points at 2 PM EST. By the time the Chairman finished his Q&A post-decision, the market reversed 120 points to end -100 points down, the market took me in with slight slippage but I flattened out +95 points the /ES is $50 per point, and $12.50/tick. So if I calculated work from The Fed rate decision to the end of the meeting After commission costs, I secured $4745.82 after the r/t commissions, given I only had 1 all-or-nothing trade trading the rate decision. That was the span of 1.5 hours, if you want to calculate the hourly wage that was approximately $3163.88 / Hour. (Remember results aren't typical, refer to disclaimers here.)

- Flexible Trading Hours: You can trade even with a full-time job. You can trade the overnight session in Asia or Europe before you sleep or any session you choose. Furthermore, you also get a 1-hour break guaranteed after the USA session closes. With stocks, you're bound to the 9:30-4 market hours.

- Transparency: Futures are more transparent than FX trading in which you're trading against your broker, your minuscule orders don't ever make it into the interbank market. Furthermore, you can trade FX futures, see volume, which doesn't exist in spot FX, and see the order book like equities. So why even trade spot FX after seeing these advantages?

- Impressive Leverage: This can be risky if used improperly, but a good trader's goal is to use leverage positively to their advantage. Poor leverage utilization will easily erase your account faster than credit card debt erases your checking account. Some brokers intraday give $500 intraday margins: Meaning you have leverage of 450:1 intraday if the SP500 notional value in cash is $225,000 (CME calculation is $50 x SP500 Index Value, thus if SP500 at 4500, $225,000 is notional cash value) Find another asset class that offers this kind of leverage, and no don't mention bucketshop overseas FX brokers in Cyprus offering 1000:1 leverage. Equities at most give a 4:1 margin against your capital and assets. (Once more refer to the disclaimers.)

- Taxation Advantages & Marked to Market (MTM): A benefit of futures is that it is Marked to Market every day, so your PnL is what it is when your account settles into the next trading day. There is no lame T+3 settlement like in equities where you can be deemed insolvent until your securities clear. Futures enjoy 60/40 blended taxation which treats PnL as 60% long-term and 40% short-term capital gains. (Consult a licensed CPA for any tax advice.)

- Speculation & no Pattern Day Trader Rule: When trading futures one can trade long and short as much as they want with an account under $25,000. Also, there is no margin interest assessed for holding overnight long or short. Try this with equities, let me know how it works out. With that said, this doesn't mean to be reckless with your account size. Speculation based on direction results in 2 outcomes a win or a loss. Do your research and analyses before engaging in speculative futures trading.

- Ability to Hedge Price Risk: Let's say Southwest Airlines felt they bought their fuel supplies at the top of the market, they can sell short crude oil futures against the cost of their fuel, to hedge against losses. If oil collapses, while Southwest is operating at a higher fuel cost, they are making profits with the short /CL futures, they can close and book a profit in cash to offset any losses in terms of fuel cost and operations.

- Algorithmic Trading: I utilize algorithmic trading (algos) in some of my strategies, to speed up repeat tasks such as trade execution or trade management. Learning how to leverage algos when trading futures would be beneficial because it somewhat levels the playing field against professional traders who use algorithms on a daily basis. It would help in position sizing and not trade more contracts than you need for example, as the parameters to trade are defined before execution.

Futures Trading Use Cases

- Hedging Purposes: As stated earlier, hedging is a common use for futures trading. Hedgers are usually businesses with exposure to certain assets or commodities and they need to manage risk, hence they will sell contracts against their exposure. The contracts sold get absorbed by speculators, those taking the risk for potential reward.

- Speculation: Tying in with the previous point, speculators try and take risks with outsized reward profiles, the more asymmetric the better. Speculators can range from retail individuals to Commodity Pool Operators (CPOs), Commodity Trading Advisors (CTAs) & other fund managers.

- Block Trading: Trade executions of large quantities, usually done off-exchange and reported later to not disrupt current market operations, these are usually done by institutions and broker-dealers.

- Arbitrage Trading: The trading strategy seeking to profit from price discrepancies across various markets. There can be pricing discrepancies with for example, the futures contracts, ETF, and options against the SP500, in turn, you can construct an arbitrage opportunity to sell the overvalued asset and buy those undervalued and hope for mean reversion (prices meeting at equilibrium or a fair price) to happen. This type of trading is heavily dominated by algorithmic trading and is easier said than done. Programs are developed to hunt down these specific opportunities quickly for a potentially risk-free rate of return. When a normal trader sees this, if they even see it, it's likely the opportunity will vanish in front of their eyes as they don't have a speed advantage to consistently perform such complex trades on a regular basis.

In Closing

I confidently believe my personal definition of Futures Trading is beneficial because it's coming from my 16+ years of trading experience. It isn't a cookie-cutter definition you see all over the web. I wrote it with purpose and perspective so you the reader see the human reality between the lines.

My focus on the following markets, equity index, energy, rates, and metals, give me a decent global macro perspective that is leveraged and unique, it isn't concentrated heavily nor is it overly diversified to the point where returns are diluted to those of buy and hold mutual funds.

I'd like to reiterate to those interested in Futures Trading, that it is a specialized skill that would be helpful to learn. The markets will continue to exist as long as we live in the Western world where capitalism reigns supreme. Believe me, if you weren't interested I don't think you'd be down here reading this far. Why not try and seize a piece of that infinity, learning more about Futures Trading, will open your eyes to the world and the markets and help you think logically and more objectively. You will question and break everything down in terms of risk.

I hope you enjoy reading this journal and if you enjoy it, consider supporting the journal and subscribing. When I have time I write & produce futures-focused content that is curated for those committed to succeeding in this tough game. Also, you get some extras listed on that signup page.

Thanks for your time. Trade well.

-Asymmetric_Vol

Entries of Interest

Day Trading Futures

How to Get Started

5 Favorite Strategies

Tags

Tags

Tags

Tags

Tags

Tags

Tags

Tags