Day Trading Futures as a Strategy

*Disclaimer these posts are for educational and/or entertainment purposes only. If you want more warnings and disclaimers check every footer on every page, or click here, it sends you to the same disclaimer if you're too lazy to hit [end] on your keyboard. These posts are not advice, trades you do are of your own, if we hint to try something, it's to test on a demo or at your own risk, we never guarantee profitability.*

Premise

Why traders choose to Day Trade

A popular trading strategy for Futures is Day Trading. Individuals want to be actively involved in trading the markets for various reasons. They seek action, an adrenaline rush or they like to be in control of the trade process, or all of the above. Day Trading is a viable strategy and a trader will utilize it in their career one way or another. Whatever the motive, let me go into detail about this type of trading, then you can assess if it's suitable for you.

I Started Day Trading

Believe it or not, Asymmetric_Vol started as a Day Trader. I got into it via trading spot FX when the broker FXSolutions existed in the mid-2000s.

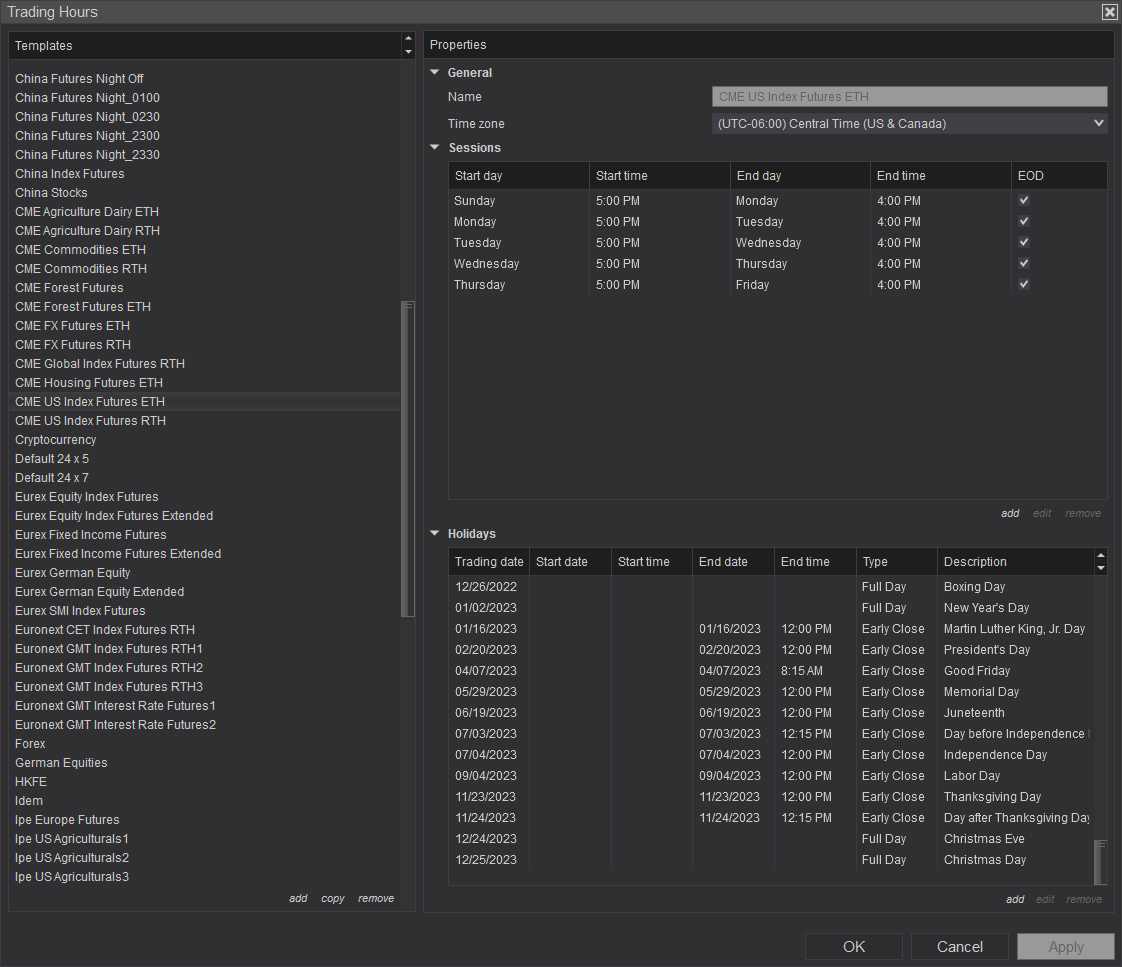

I traded with this broker because they had a very good platform at the time. I had "fun" trading spot FX until I later found it was a bucket shop scam and the CFTC dropped the regulatory hammer and forced many brokers to leave the USA and deleverage down to 50:1. How unfortunate. In the end, it was for the better, I found futures and NinjaTrader7. Things happen for a reason I suppose.

Fast Forward several Years

I needed my leverage and futures trading was where it was. Trading futures offered me 450:1 intraday with low margins. This was better than the shady FX I used to trade at 200:1. Also I found FX Futures trading here also, so if I needed a fix and wanted to trade FX it was available. However, my journey shifted from FX to Equity Index, Rates, and Energy as I gained more experience. These futures contracts shined in my eyes, they were liquid and volatile. I learned FX was a very low volatility asset class that was only magnified by leverage. Loot at the quotations, they're in single digits with hundredths of a penny in terms of calculation. Compare that to /ES or /CL, higher calculations in the ticks of 0.25 cents to 1 cent (in crude), so relative to FX, these asset classes were more volatile and heavily traded by all participants.

Transparency

Futures gave me a glimpse of transparency in trading, especially day trading because there was no such thing as market depth in fx, you were left in the dark, hoping and praying your trade was the right one.

Futures you had market depth, volume, contracts traded, ticks, etc. This gave a trader another dimension of analysis. It helped your trading mind grow, so to speak. Because one started to ask questions such as "There are a lot of contracts there, what is the market thinking? How will it react to that level?" In FX you sometimes didn't know hidden levels existed. You just traded off technicals blindly.

Numerous Approaches to Day Trading

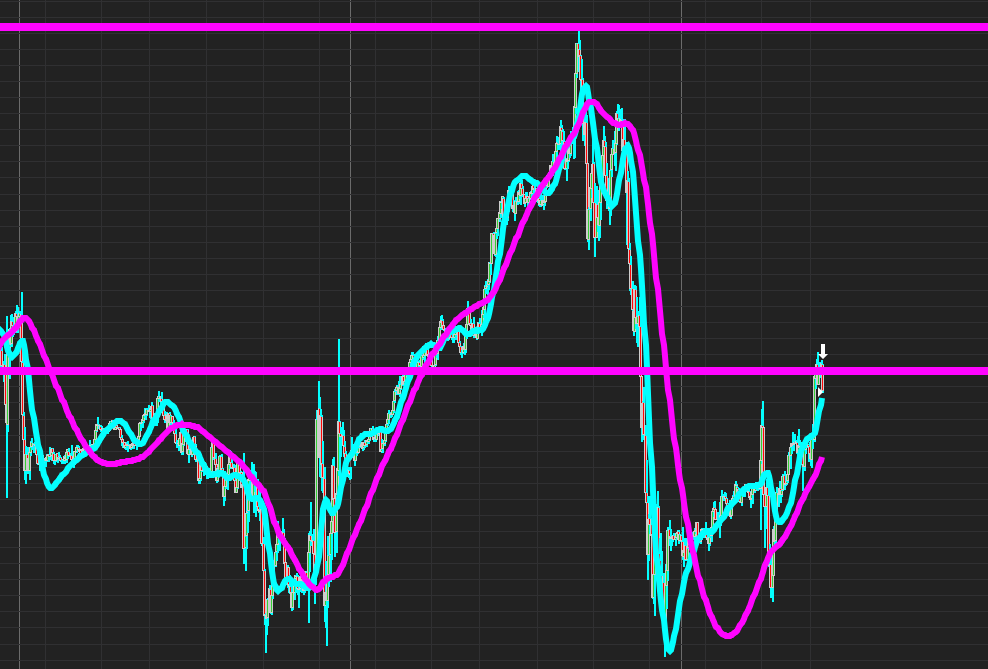

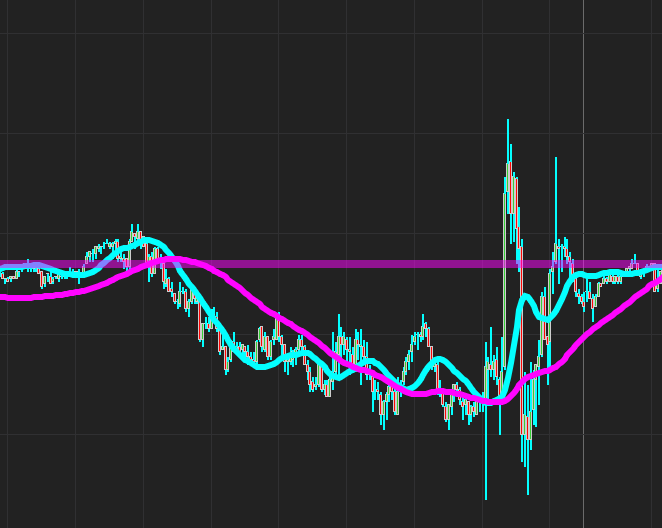

Day Trading has a thriving ecosystem in terms of tools that vary one's approach to the trading day. There are many indicators, custom indicators, and systems developed for the task.

In terms of approach, one can trade via the following examples.

- Momentum Trading: One can use momentum indicators such as RSI and Volume to gauge market direction, and "momentum" of the market. Where buyers are dominant and where prices are being driven.

- Support and Resistance Trading: A trader can plot out overnight levels and devise strategies to trade such levels. They factor in position sizes and risk beforehand and try to keep the trades simple.

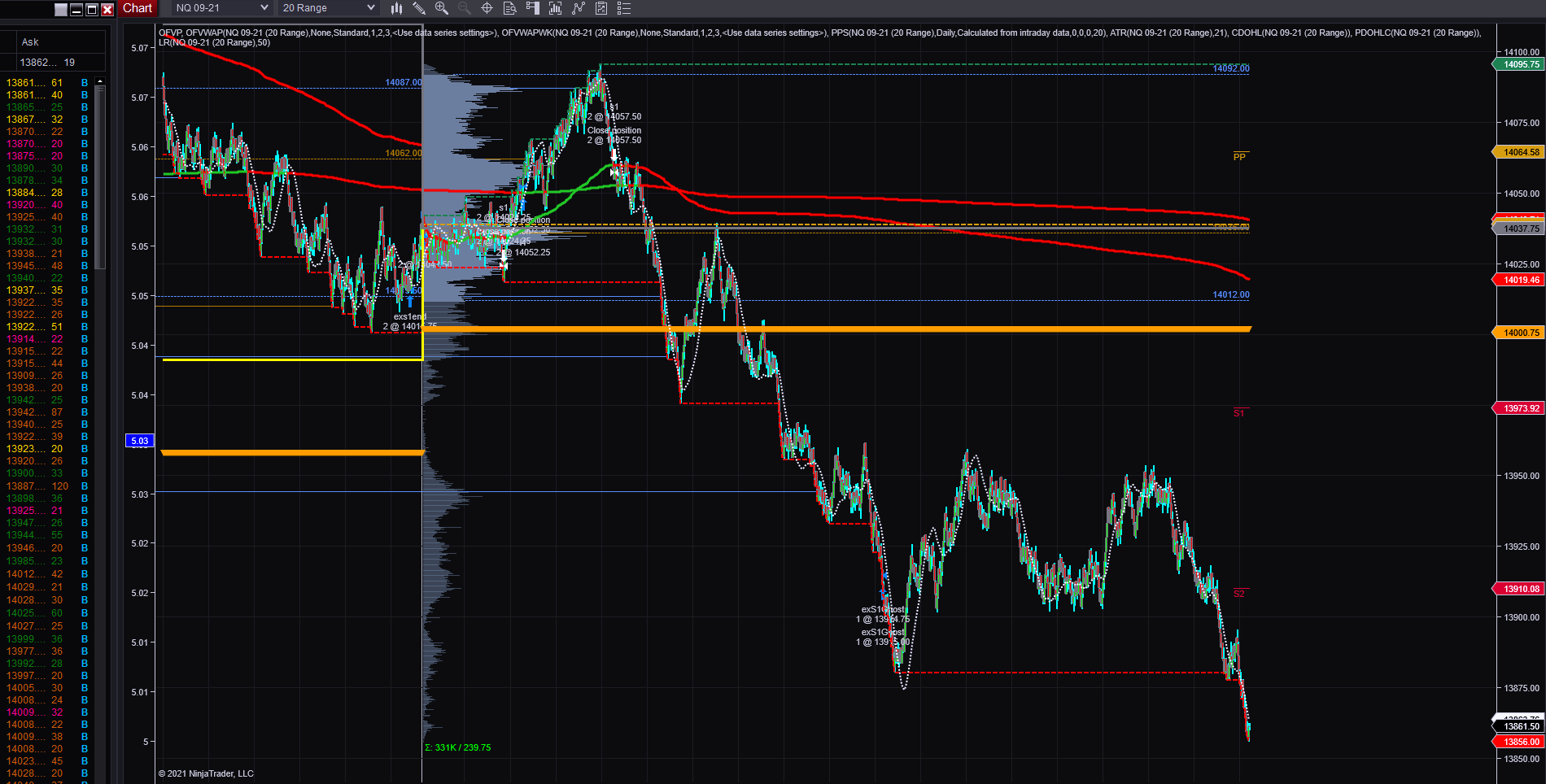

- Order Flow Trading: A trader utilizes order flow tools to see where committed buyers and sellers are, it's like momentum trading but more in-depth in terms of price analysis. They try and find levels where buyers have been exhausted or trapped and short, the same goes for trading against shorts, just in reverse.

- Scalping: This is a trading strategy trying to capitalize on quick price fluctuations, this is a very high-frequency form of trading, and the trader has to capture the spread + commission to break even at a minimum. There's a lot of action here, traders use short timeframes, tick charts, M1 or M5 timeframes, range bars, etc.

Those 4 examples are just a handful of Day Trading approaches one can utilize to extract alpha from the markets. I've used them all and if I do Day Trade I personally would use a combination of these techniques, just to reinforce my current perception of the market's state.

Reality and the Risks of Day Trading

Now that I've given you some insight on strategies and concepts that you'd like to hear, allow me to hit you with some reality that you may not want to hear. Day Trading has a high failure rate. Let me tell you why with the following examples.

Delusions of Grandeur

Traders get deluded in terms of profits. They initiate a short futures position as a Day Trade, just because they feel the market is going to drop without any supporting data to reinforce their short position, mistake 1. They get lucky and get into profit quickly. They exit at a profit, they didn't even plan an exit, they just felt they had to take it, mistake 2.

Euphoria the Killer of your Trading Career

With these 2 unknown errors, they are euphoric, they start daydreaming about the future millions they can make! Wow, how come not a lot of people do this? (A lot have failed and moved on to other careers). They didn't know that trade was pretty much based on luck. Let's see if they can replicate it.

They feel good! They are short again. It's so easy, isn't it? Little did they know they were the last shorts and there are no more sellers, buyers start to step in. He is quickly at a loss as his short friends are getting stopped out of the market. The trader doesn't know what to do, and freaks out because the open loss is double the profit he luckily made earlier.

He exits at a loss and thinks it's a scam. Quits trading forever. Trading isn't easy, in my opinion, it's one of the hardest professions to make easy money. It's never guaranteed. The only guarantee in trading is you pay the R/T commissions in and out, win or lose.

Every Trade Starts as a Loser!? Yes.

You are losing from the start because of the commission costs. And if you Day Trade excessively, you're churning your account and your broker loves this. They're getting their cash flow from your account. This is their business model. It's not their responsibility for you to trade profitably, they want you to keep your account open and trade so they can get commissions.

Day Traders the Perfect Broker Client

The perfect client for them is one that is breakeven. Not profitable, and not one that blows up the account. Why? So they have your cash to lend out at overnight rates if necessary, and available so you can trade and burn commissions through your balance.

Traders don't look at it from this perspective. Remember conflicts of interest exist. Always ask questions.

It's like people buying hot luxury goods, trying to make money. They don't know they are the end user, it's not designed for them (the consumer) to make money. The money made is by luck and demand. The winner is the seller, their cost of goods will be superior to that of the consumer who pays retail price.

Traders are the end consumer, they are to participate and generate commissions 1st. 2nd Keep the account open with the broker for as long as possible, so it redirects back to 1st point. 3rd some profitability to generate a small sense of hope which loops back to 1 and 2.

See our perspective?

Most traders don't approach trading how we do, they just want to get in and try to make money ASAP. We look at who we're trading against and try to skew the odds in our favor. Be that trading a specific strategy that is backed by data or optimized to perform well in the long term, or utilizing tools that give us information that reinforces our conviction to execute a trade with pre-defined risks.

Asymmetric_Vol likes to know what is going on at all times, and having data ahead of time and on-demand is critical versus guessing via gut feeling.

There are many trading and investment cliches I can regurgitate here but you can Google them yourself, we prefer to not display our expertise based on borrowed knowledge. In fact, we make our own sayings and quotes. Here is one.

Execution is Everything in Trading

-Asymmetric_Vol

Think about that, you heard it here 1st. Execution is everything in Trading. Why? Through experience we learned if you execute the trade the best, it doesn't matter what strategy you trade, you skew the odds in your favor in terms of positive expected outcomes.

Outcomes such as:

- Limiting the risk of loss

- Perfect trade execution leading to desired profitability outcomes

- Exiting profitably

- Losing the least, less than a maximum expected loss

- Reduction of commission impact

Should I Still Day Trade?

With all the harsh reality checks I've given you, you might be wondering if you should still try Day Trading. We advise against you doing anything that could put you in financial peril. At least learn more about Day Trading, and what it takes to succeed (though the numbers are low), some of the best Day Traders exist out there and they do make a living out of trading the markets.

You need to be well-capitalized and know all the nuances when Day Trading Futures. Know your broker, their business model, their rules, and their margins.

Leverage and Margin

Respect these 2 aspects and use them wisely. If you abuse leverage, and overtrade it is the fast track to nuke your account to $0 and get banned by your broker. They will see you as a risk and just liquidate you via margin calls, impose account restrictions, or just close your account overall to name a few things.

Develop and Test a Strategy

There are many strategies for Day Trading, you can develop your own or find one you can trade if it is to your liking. Always test it either via a demo to see if it even works and if you can execute it properly. Or you can backtest it if you have coding knowledge. Code the trading logic into your platform of choice and test it.

Discount the results by 25%

If it does and you have a profit for a month or so, discount that profit by 25% because demo accounts are perfect trading conditions. The discount factor of 25% is to calculate the projected reality of commissions and unforeseen loss factors such as disconnects and slippage. This factor is based on heuristic experience and we strongly believe it's a fair variable to utilize.

This Journal will go into further depth into strategies, so stay tuned and subscribe.

Concluding Thoughts

You learned about Asymmetric_Vol's humble beginnings as a Day Trader, starting with FX and transitioning to Futures. Different trading approaches you can take from Support and Resistance Trading to Order Flow trading, the approaches are almost limitless.

Furthermore, you learned about the risks and reality of Day Trading, how it's very difficult and has a high failure rate. You gleaned some insights on the various risks and the broker business model. You also learned from our perspectives and saw trading from a different angle that most individuals don't see.

Lastly, you're presented with the question if Day Trading is for you. We leave that for you to answer yourself through learning or selecting other strategies to fit your situation and capabilities.

Trade Safe

~Asymmetric_Vol

Ultimately...

In terms of Day Trading, we might share some Subscriber Exclusive Strategies backed by data that you can absorb with your learning. There is no guarantee the strategies will remain profitable, always see our risk disclaimer at the footer. They are in-depth insights into the thought process of experienced traders versus those who trade for fun. We trade to make money, not to have fun.

If you find these journal entries helpful, please consider subscribing here. The team at A81k is grateful for your support.

~Asymmetric_Vol

Entries of Interest