5 Futures Trading Strategies: An Overview of My Favorites

Introduction

*Disclaimer these posts are for educational and/or entertainment purposes only. If you want more warnings and disclaimers check every footer on every page, or click here, it sends you to the same disclaimer if you're too lazy to hit [end] on your keyboard. These posts are not advice, trades you do are of your own, if we hint to try something, it's to test on a demo or at your own risk, we never guarantee profitability.*

My 5 Strategies for Trading Futures

Futures can be traded in a variety of ways, it depends on the individual's style and schedule. I trade futures for a living so I can deploy these strategies at my leisure. Here are my 5 favorite futures trading strategies.

- Swing Trading - A good strategy with a full-time job and only a few moments per day to analyze and trade the markets. The trader focuses on market swings.

- Day Trading - For the trader who can commit more than a few hours per trading day. The action is higher, along with the commission cost.

- Algorithmic Trading - For the highly technical trader, utilizes automation to place and manage trades, theoretically eliminating most of the emotion tied to trading.

- Trend Trading - Another good strategy for part-time traders, it follows long-term price trends

- Scalping - Day trading with excessive self-engineered action, this kind of trading involves more luck and gut feeling, and perception of the mob mentality at the moment than logic and pure strategy. Highly commission intensive.

With that given list, I will go into further detail explaining what each strategy entails and why I utilize them. Read on.

Swing Trading a well-balanced Trading Strategy

I've stated in my first point that Swing Trading is great for part-time traders. The reason is that you can focus on whatever your full-time job is without stressing about the markets.

Swing trading allows you to define risk and trade your strategy maybe once a day, check its performance the next day or so and manage it accordingly. Your broker having a mobile app will help with this style of trading. When you're at home you can analyze your tradeable markets in detail given the free time you have.

An example Swing Trading Strategy

Let's say a trader trades candlestick patterns such as hammers and shooting stars at support or resistance levels. They plot the significant levels and wait for the entry signals to develop. They trade daily timeframe so they wait for some time.

An entry finally happens, a hammer forms and closes as a bullish candle, and the candle wick is long and strongly repelled the support levels the trader has defined.

The trader enters long, defined risk beyond the wick as their stop loss of approximately 25 points, they target the next high that was 2 months ago when the price sold off, which is 200 points away.

The trader goes to sleep, wakes up, and goes to work. During lunch, they check their positions on the mobile app and see their position advancing, up 75 points. They feel good. They go back to work. They get home, spend time with family, have dinner, and check positions again before sleeping. The swing trade is doing good.

Over the next week, their position advanced to 180+ points in profit approaching their target. They keep an eye on the levels, at the end of the day, the trader saw a shooting star form and closed red, it missed the 200+ point target by 20 points but the trader is ahead +150 points. They close out the position and wait for a new entry.

1 trade in 2 weeks, minimal stress. Swing trading is a good middle-ground strategy anyone can deploy.

Day Trading a Strategy for the Full-time Active Trader

Day Trading is good for those who have a lot of capital saved to pay for their daily fixed expenses so they can attempt to trade for a living. Day trading is very active and can be employed during various market hours. You can trade Asia market hours, Europe, the USA, or all of the sessions. Just be wary of mental fatigue, and make sure you're well-rested before trading so you minimize clouded day trading decisions.

An example Day Trading Strategy

A Trader wakes up at 8 AM EST and checks the overnight news. There are a lot of central banks that cut rates overnight, futures are up. There is market speculation that the US Federal Reserve might follow suit and cut rates as well. Pre-market opening vol (volatility) is elevated.

The Trader believes a breakout strategy would be optimal. They use Keltner channels to define the ranges and place OCO (order cancels other) buy and sell stops to take them into the market if the price breaches said levels. They place these around 9 AM EST.

9:30 AM. USA markets open the bell rings. The market explodes to the upside and takes the trader into a long position. The short order is cancelled and replaced with a stop loss and a target to sell is placed 3x that risk.

10:30 AM, the market keeps rallying and takes out the trader's take profit. Great trade.

Next, The Fed speaks at 11 AM. The trader waits for clues like a shark waiting for blood. The market volatility quiets down in anticipation.

THE FED DECIDES TO HOLD RATES STEADY as INFLATION IS STILL PERSISTENT.

THE MARKET STARTS TO COLLAPSE.

The Trader sees the blood after this announcement. All longs are trapped now. Bull trap! Selling pressure builds as traders are crushed out of their positions, the high of the day is made at 1230 PM EST. Markets start to plummet at 12:31 PM, and the trader shorts the market into the volume. They're filled with a market order, with a stop loss of 10 points beyond the high of the day. This time the target is 5x that risk.

The Trader assessed this surprise decision will erase the rally of the overnight session. They are trading with earned profits so any loss will still be a net profit.

The Trader was right, the market crashed 120 points and hit their target of 5x reward vs the risk taken. And the market went beyond his target of a potential 7x return to risk it closed at lows by 4 PM EST.

Day Trading in this form involves a lot of quick thinking and participates in a lot of action. Results are not typical (refer to risk disclaimer below). Profits can be made, however, losses are more common. Most traders lose money trading, thus learn to define risk well and manage it properly, and the profits can potentially materialize.

Algorithmic Trading an Automated Method for the Technical Trader

Algorithmic (Algo) Trading is one of my favorite trading strategies because it is the future. It utilizes human intelligence with machine speed and accuracy. With the advent of AI, I'm convinced algorithmic trading has a strong dominant future. Almost all professional trading institutions employ algorithmic trading in one way shape or form.

Professional Examples of Algo Trading

Citigroup or Bank of America Securities (Formerly Merrill Lynch) might use algorithmic trading for market-making operations during market hours, buying and selling securities for their firms.

Citadel and Virtu Financial make markets using algorithms and higher-frequency trading programs.

A Hedge Fund Manager might have their traders deploy algorithms to trade their portfolios.

How a Trader can utilize Algo Trading to their advantage

Algorithmic Trading can be deployed by traders by automating their defined strategies. Instead of entering them manually, the entries, exits, risks, and returns can be coded and executed by the trading platform.

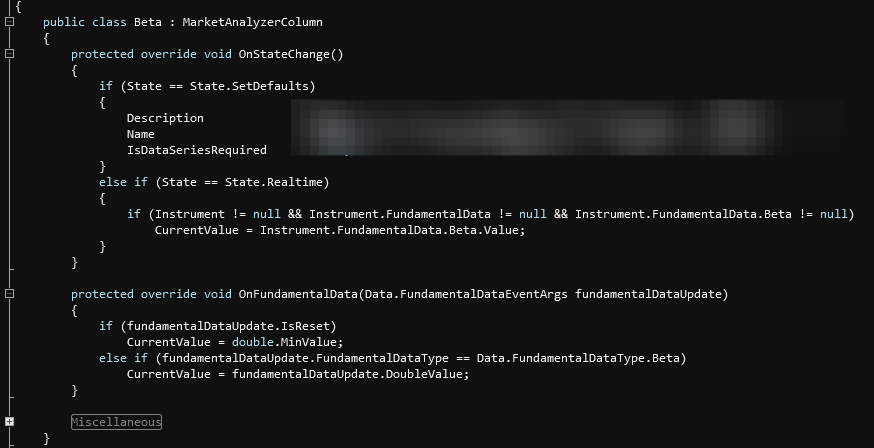

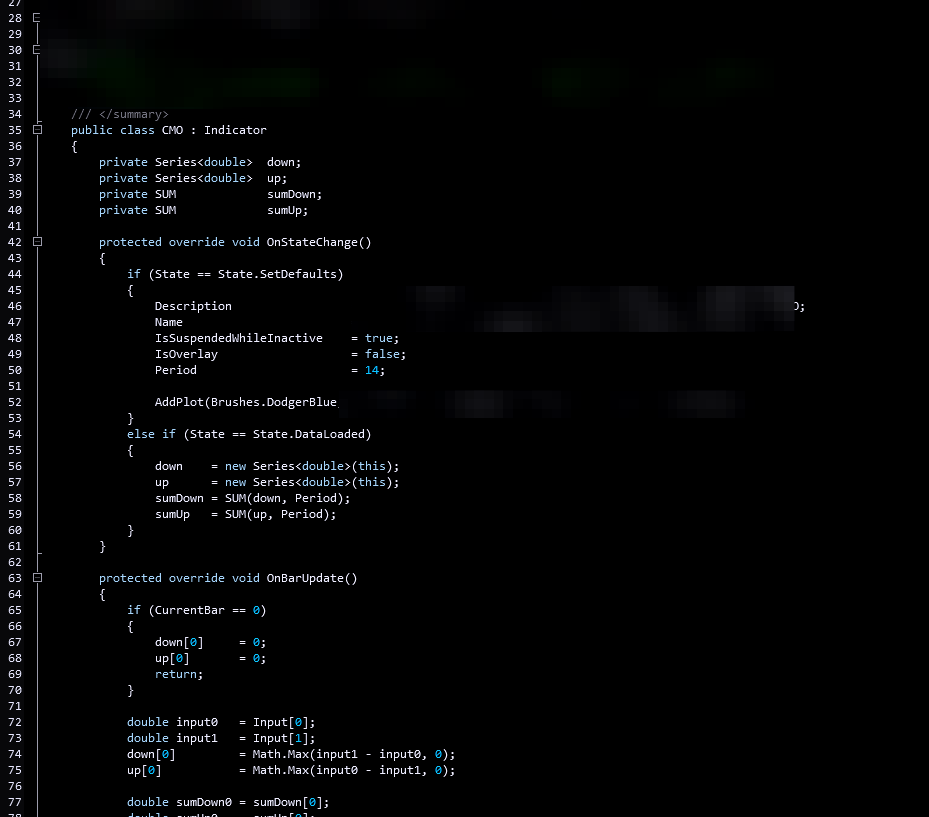

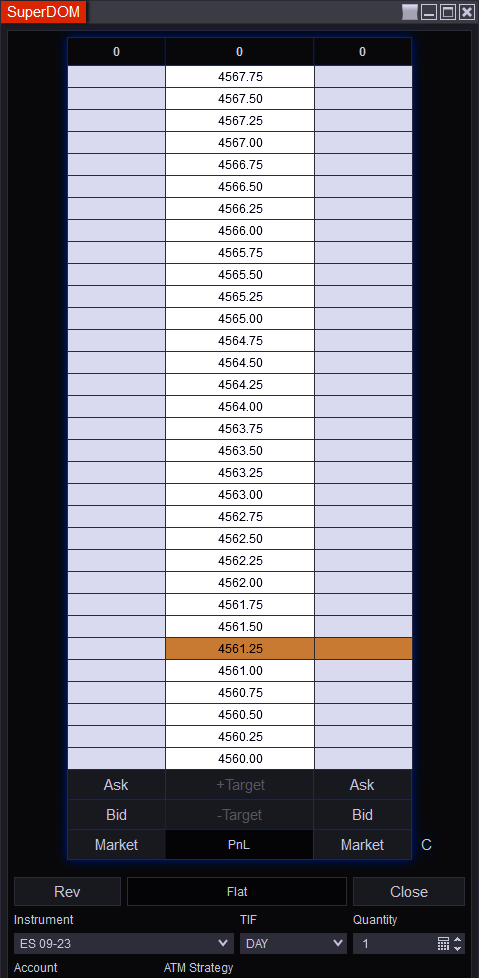

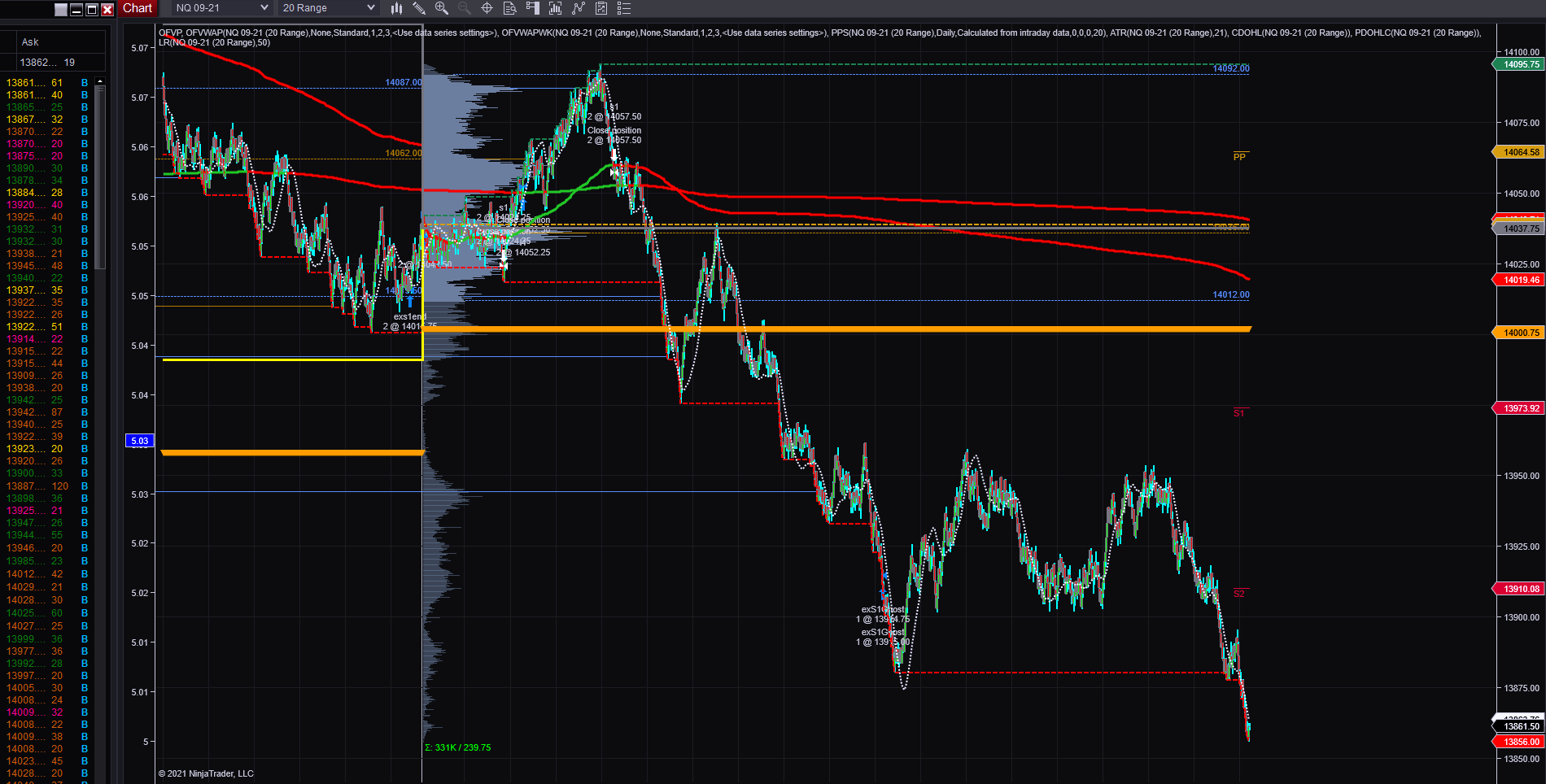

My trading platform NinjaTrader 8 does this and that's why it's my platform of choice. Almost any strategy can be coded if it has defined rules. Discretionary strategies are harder to code and test due to the factor of discretion.

Algorithmic Trading improves accuracy and execution versus a manual/discretionary trader.

Algo trading can be utilized for the other strategies stated: Swing Trading, Day Trading, Trend Trading, and Scalping.

Lastly one can test if a strategy even stands a chance of working live in the long term backed by data not solely by luck and chance.

A lot of discretionary traders are deluded thinking their manual strategy has a long-term positive expectancy (profitability) by seeing profitable results in a small sample size of less than 100 trades.

Robust trading strategies that generate α in the long run survive past 100 trades and generate returns for years. Usually, these strategies are the least complex and focus more on execution and risk management primarily, with returns as secondary.

Algorithmic Trading pushes trading into another dimension and nearly levels the playing field against trading professionals.

Trend Trading the long Term Time Tested Approach

Trend Trading is employed by some of the best traders in the world. Think Ed Seykota and John W. Henry to name a few. These are legends in the commodities trading space and have produced excess returns over the decades.

How Trend Trading Works & How a Trader can use it?

In the basic sense, one follows price trends, up or down. They trade for very asymmetric returns and build positions over time.

A Trend Trader can use basic moving averages such as a 200-day on a daily chart, and go long above it, and short below it. Reverse when the trend changes.

The benefit of this kind of trading is that it is very low frequency. You watch the markets only a few times a day or even a week. And you manage it accordingly.

The drawback is that given its low frequency, your account size has to be able to withstand extensive drawdowns because there can be long periods of waiting for the market advance that doesn't come when you want it to. Most people can't handle this.

As they say:

No pain no gain.

Trend trading isn't for everyone, it's for those with significant account sizes that are able to withstand long periods of consolidations. However, when the market trends in your favor, the returns can be greater than that of other strategies given the cost of entering and exiting positions, and less psychological toll it takes if you have a sufficient account size.

Scalping the High-Frequency Day Trading Approach

If you have a gambling itch this trading style might fit for you. Though I don't recommend you view scalping from this perspective (remember any opinions are just advice not recommendations to do anything, refer to the disclaimer link at the footer of every page). This is very active and in and out of the markets in quick succession. It is very commission-intensive. If that doesn't deter you, however, read on.

How Can you use Scalping as a Trader?

A trader would usually look for highly volatile situations to scalp trades. They would usually use low time frames such as 1-5 minute charts, even tick charts to base their scalping trades.

From experience, this trading is more irrational and relies on active market perception. What is market perception? Basically, you have a feel for market sentiment, the feeling of the crowd, if they're bearish or bullish you look to capitalize on these sentiments.

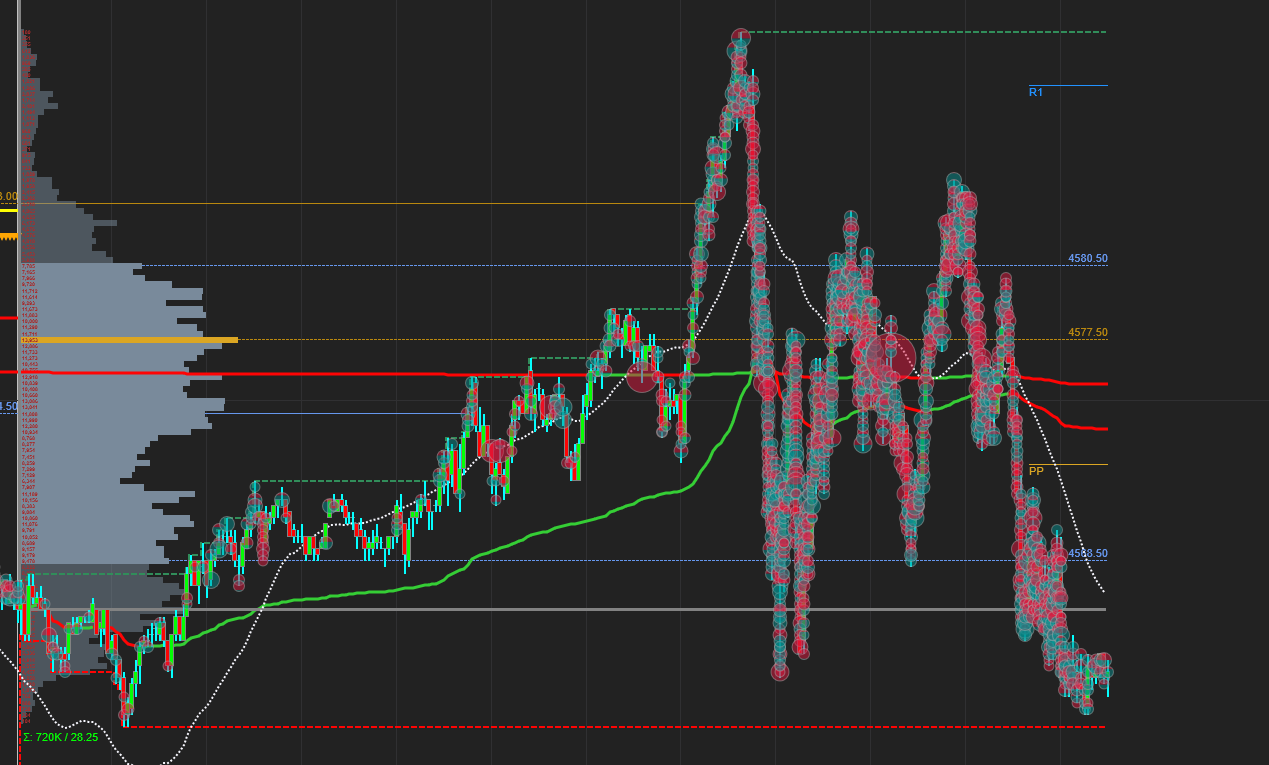

A Scalper would trade in the Depth of Market(DOM), a part of the futures trading platform with the bid/ask columns stacked with the market depth showing all pending orders and they trade based on how these orders trade. It involves a lot of screen time and is very difficult to teach through writing.

A trader would try and capture the spread + commission at least when scalping to break even, anything in excess is considered profit.

Just know this kind of trading has the most action one seeks. You're going to need a lot of coffee and food at your desk. It requires the most attention because if you even blink, an opportunity lost can be considered equivalent to a loss.

In Conclusion of my Favorite Trading Strategies

I hope this quick overview gave you the reader and prospective trader a glimpse of the various strategies at your disposal. You can try these strategies on your own or with a demo to see if they are fit for your style of trading.

Swing Trading is a good balance of short to medium-term trading. The account sizes are manageable and work with a part-time trader working a full-time job.

Day Trading is a good option for traders who want to commit to full-time trading and be more active in the market trading sessions. It's more commission-intensive, but there is more action.

Algorithmic Trading is the most structured approach. You can use it to test any of these strategies, they can be coded and traded automatically if you wished. This is one of my favorites because it provides many options and requires logical thinking. When you have in-depth knowledge of functions and market dynamics, I strongly believe it enables you to become a better speculator.

Trend Trading is a longer-term approach for those who can withstand long-term drawdowns and have sufficient account sizes. When these 2 conditions are met, traders of this strategy can realize long-term potential profits with less stress. Some of the best portfolio managers and traders are Trend Traders. It doesn't hurt to emulate what's worked for those who've succeded.

Scalping is a very short-term high-frequency trading technique capturing the spread + commission. It is great for those day traders that want the most action and like to micro-manage every aspect of the trade. It is focused and commission-intensive. It has the highest stressors relative to other strategies.

Once again give these favorite trading strategies of mine a shot. You'll find you like one over the others, or like a few. There's always a style to fit someone's trading needs.

Trade Safe

~Asymmetric_Vol

Lastly...

If you find these journal entries helpful, please consider subscribing here. The team at A81k is grateful for your support.

~Asymmetric_Vol

Entries of Interest

Day Trading

How to get Started

What is Futures Trading